Το MyBookie προσφέρει ένα καζίνο Sunday Extra, επιτρέποντας στους συμμετέχοντες να κερδίσουν ένα μπόνους 200% περίπου 500$ για καταθέσεις 100$ ή υψηλότερες. Αυτές οι συχνές καμπάνιες καθιστούν το MyBookie μια ελκυστική επιλογή για παίκτες που αναζητούν την πραγματική αξία χρησιμοποιώντας τις τοποθεσίες τους. Read More

Descubra a Magia do Betway Casino: Emoções e Oportunidades em Cada Jogada

O Betway Casino é um dos destinos mais populares para os entusiastas dos jogos de azar, oferecendo uma ampla gama de opções que atendem a todos os gostos. Neste artigo, vamos explorar as diversas facetas deste emocionante cassino online, suas ofertas, a experiência do usuário e as vantagens que proporciona. Prepare-se para uma jornada cheia de surpresas e prêmios!

Sumário

- A História do Betway Casino

- Os Jogos Oferecidos

- Promoções e Bônus

- A Experiência do Usuário

- Perguntas Frequentes

A História do Betway Casino

Fundado em 2006, o Betway Casino rapidamente se destacou na indústria dos jogos online. Com um compromisso com a segurança e a transparência, o cassino ganhou a confiança de jogadores em todo o mundo. Sua plataforma é licenciada e regulada por autoridades respeitáveis, o que garante que todas as atividades sejam justas e seguras.

Uma das principais inovações do Betway foi a introdução de várias opções de pagamento, permitindo que os jogadores façam depósitos e saques de forma fácil e conveniente. Além disso, o compromisso da empresa com a responsabilidade social é evidente através de suas políticas de jogo responsável.

Os Jogos Oferecidos

O Betway Casino possui uma vasta seleção de jogos, desde as clássicas máquinas caça-níqueis até jogos de mesa emocionantes. Confira a tabela abaixo para uma visão geral das principais categorias de jogos disponíveis:

| Categorias | Exemplos de Jogos |

|---|---|

| Máquinas Caça-níqueis | Book of Dead, Starburst, Gonzo's Quest |

| Jogos de Mesa | Blackjack, Roleta, Bacará |

| Jogos de Dealer Ao Vivo | Blackjack ao Vivo, Roleta ao Vivo |

| Videopoker | Jacks or Better, Deuces Wild |

Apostando com Segurança

Todos os jogos do Betway Casino usam tecnologia de geração de números aleatórios (RNG), garantindo resultados justos e aleatórios. Isso significa que você pode jogar com confiança, sabendo que a integridade dos jogos é mantida.

Promoções e Bônus

Uma das melhores maneiras de aproveitar o Betway Casino é através de suas promoções e bônus generosos. Veja algumas das ofertas que os jogadores podem explorar:

- Bônus de Boas-Vindas: Geralmente inclui um match de % em seu primeiro depósito, permitindo que você jogue por mais tempo.

- Promoções Semanais: Fique atento a promoções específicas que podem oferecer rodadas grátis em jogos selecionados.

- Programa de Fidelidade: Acumule pontos jogando e troque-os por bônus e prêmios exclusivos.

Como Aproveitar ao Máximo as Promoções

Para tirar o máximo proveito das promoções do Betway Casino, os jogadores devem ler os termos e condições de cada oferta. Isso garante que não haja surpresas e você esteja ciente de quaisquer requisitos de apostas que possam ser necessários.

A Experiência do Usuário

O Betway Casino se destaca não apenas pela sua diversidade de jogos, mas também pela experiência do usuário que oferece. Sua interface é intuitiva, permitindo que os jogadores navegarem facilmente entre as diferentes seções. Aqui estão alguns pontos a considerar:

- Suporte https://betwaycasinobrasil.com/ ao Cliente: O Betway oferece suporte 24/7, com várias opções de contato, incluindo chat ao vivo, e-mail e telefone.

- Acessibilidade: O cassino é acessível em dispositivos móveis, permitindo que você jogue onde quer que esteja.

- Variedade de Métodos de Pagamento: O site aceita diversos métodos de pagamento, como cartões de crédito, carteiras eletrônicas e transferências bancárias.

Dicas para uma Experiência Agradável

Para melhorar ainda mais sua experiência no Betway Casino, considere as seguintes dicas:

- Mantenha um orçamento para suas apostas.

- Experimente jogos diferentes para descobrir seus favoritos.

- Participe de promoções e eventos especiais sempre que possível.

Perguntas Frequentes

1. O Betway Casino é seguro?

Sim, o Betway Casino é licenciado e regulado, garantindo a segurança e a integridade dos jogos.

2. Quais métodos de pagamento são aceitos?

O cassino acepta uma variedade de métodos, incluindo cartões de crédito, débito, e-wallets como PayPal e Neteller, e transferências bancárias.

3. Como posso retirar meus ganhos?

Os jogadores podem solicitar retiradas através do método de pagamento utilizado para o depósito, seguindo as etapas disponíveis na plataforma.

4. Posso jogar no Betway Casino no meu celular?

Sim, o Betway Casino possui uma versão otimizada para dispositivos móveis, permitindo que você jogue de qualquer lugar.

Concluindo, o Betway Casino se destaca como uma opção excelente para jogadores que buscam uma experiência diversificada e segura. Com suas promoções atraentes e uma vasta seleção de jogos, não há dúvida de que o Betway pode oferecer a emoção e os prêmios que você procura!

Discover the Thrills: Your Guide to No Deposit Bonus Codes at Raging Bull Casino

Welcome to the vibrant world of Raging Bull Casino, where excitement and endless possibilities collide! If you’re looking to make the most of your gaming experience without spending a dime upfront, you’re in the right place. In this article, we will explore everything you need to know about Raging Bull Casino no deposit bonus codes. Whether you're a seasoned player or just starting your journey, these bonus codes open the door to thrilling gaming opportunities.

Table of Contents

- What is a No Deposit Bonus?

- How to Get Raging Bull Casino No Deposit Bonus Codes

- Benefits of No Deposit Bonuses

- Popular Games at Raging Bull Casino

- Frequently Asked Questions

- Final Thoughts

What is a No Deposit Bonus?

A no deposit bonus is an irresistible offer provided by online casinos that allows players to access a certain amount of free funds or spins without the need to make a deposit. This type of bonus is an ideal way to try out various games and features of the casino, enhancing your overall gaming experience while enabling you to keep any winnings generated from the bonus.

How to Get Raging Bull Casino No Deposit Bonus Codes

Obtaining no deposit bonus codes for Raging Bull Casino is a breeze. Here’s how you can snag these fabulous rewards:

- Sign Up: Create a new account on the Raging Bull Casino website. Make sure to use accurate information.

- Check Promotions: Visit the promotions page frequently to discover the latest no deposit bonus codes available.

- Subscribe to Newsletters: Sign up for Raging Bull Casino newsletters to receive exclusive offers directly in your inbox.

- Follow on Social Media: Keep an eye on Raging Bull's social media platforms for the latest updates and promotions.

Benefits of No Deposit Bonuses

No deposit bonuses come with an array of advantages, making them highly sought after by players:

- Risk-Free Experience: You can explore games without the pressure of losing your own money.

- Test the Waters: Find out which games you enjoy the most without committing your funds.

- Potential for Real Winnings: Any winnings from your bonus can often be cashed out, subject to terms and conditions.

- No Strings Attached: Many no deposit bonuses come with minimal wagering requirements, making it easier to cash out your winnings.

Popular Games at Raging Bull Casino

The beauty of Raging Bull https://raging-bull-casino.us/ Casino lies in its extensive library of games. Here’s a look at some top choices where you can use those valuable no deposit bonuses:

| Game Title | Type | Theme |

|---|---|---|

| Lucky 7's | Slot | Classic |

| Blackjack 21 | Table Game | Card |

| Roulette Royale | Table Game | Casino |

| Tropical Treasures | Slot | Adventure |

| Jewel of the Nile | Slot | Egyptian |

Frequently Asked Questions

To further assist you in maximizing your experience at Raging Bull Casino, we’ve compiled a list of frequently asked questions regarding no deposit bonuses:

1. How do I claim my no deposit bonus?

After signing up, simply enter your bonus code in the appropriate section or follow the instructions outlined in the promotions area of the website.

2. Are there any wagering requirements?

Yes, most no deposit bonuses have wagering requirements that must be met before you can withdraw any winnings. Always read the terms and conditions attached to the bonus.

3. Can I use my no deposit bonus on any game?

While many games are eligible, some restrictions may apply. Slots usually have the best eligibility, while table games may be limited. Check the conditions of your bonus for specifics.

4. What happens if I win using a no deposit bonus?

If you win while using a no deposit bonus, your winnings are subject to the casino’s wagering requirements but can generally be withdrawn once you meet those conditions.

5. How often can I use no deposit bonus codes?

Typically, you can use each unique no deposit bonus code once per player. New codes may be released periodically, providing additional opportunities.

Final Thoughts

Raging Bull Casino is a treasure trove for both new and experienced players, especially when it comes to taking advantage of no deposit bonus codes. With the right approach, you can dive into a world of thrilling games, test your luck with zero financial commitment, and potentially walk away with fantastic winnings. Don’t miss out on the opportunity to unlock these bonus codes and experience the excitement that Raging Bull Casino offers! Happy gaming!

1xBet Download APP: Your Gateway to Seamless Betting

If you’re an avid sports fan or a betting enthusiast, the 1xBet Download APP 1xbet login app is a must-have tool in your arsenal. The 1xBet app offers a robust platform for placing bets, tracking odds, and more—all from the convenience of your mobile device. In this article, we will explore the features of the 1xBet app, the benefits of downloading it, and a detailed guide on how to get started.

Why Choose the 1xBet App?

The 1xBet app has rapidly gained popularity among bettors for several reasons:

- User-Friendly Interface: The app boasts an intuitive design that makes navigating through various sports markets and betting options a breeze.

- Live Betting: With the app, you can place live bets in real time, enhancing the excitement of your favorite games.

- Wide Range of Markets: The app provides access to a vast selection of sports events, including football, basketball, tennis, and many more.

- Live Streaming: Users can watch live games directly within the app, allowing for an immersive betting experience.

- Promotions and Bonuses: The app frequently offers exclusive promotions, ensuring that you get the most value for your bets.

Steps to Download the 1xBet App

Whether you’re using an Android or iOS device, downloading the 1xBet app is a simple process. Here’s how you can do it:

For Android Users:

- Visit the official 1xBet website or click the link provided on their promotions page.

- Locate the download section for the Android app.

- Download the APK file directly to your device.

- Before installing, go to your device’s settings and enable installation from unknown sources.

- Open the downloaded APK and follow the on-screen instructions to complete the installation.

For iOS Users:

- Open the App Store on your iPhone or iPad.

- Search for “1xBet” in the search bar.

- Download and install the app as you would with any other application.

Features of the 1xBet App

The 1xBet app is designed not just for convenience but also to enhance your overall betting experience:

- Personalized Notifications: Receive updates on your favorite teams, events, and special promotions tailored to your preferences.

- In-App Payment Options: The app supports multiple payment methods, allowing you to make deposits and withdrawals seamlessly.

- Casino Games: In addition to sports betting, the app features a wide array of casino games, including slots, poker, and table games.

- Multilingual Support: The app is available in several languages, making it accessible to a global audience.

Benefits of Using the 1xBet App

The 1xBet app is more than just a betting tool; it also offers numerous benefits that enhance the overall user experience:

- Convenience: Bet anytime and anywhere without the need to be glued to your desktop computer.

- Faster Transactions: With mobile payment options, your betting process is quicker and more efficient.

- Instant Updates: Keep track of live odds and results in real-time, ensuring you’re always in the loop.

- Access to Exclusive Bonuses: Some promotions are exclusively available through the app, giving you even more opportunities to maximize your betting potential.

Conclusion

The 1xBet app stands out as a premier choice for mobile betting enthusiasts. With its user-friendly interface, extensive market coverage, and exciting features, it provides everything you need for a successful betting journey. Whether you’re following your favorite sports teams or trying your luck at casino games, downloading the 1xBet app is a step toward enhancing your overall experience. Don’t miss out—download the app today and start betting on the go!

Step into the exciting world of online casinos, where the thrill of the game meets the convenience of your screen. Discover a vast selection of games and the chance to win real money, all from the comfort of home. It's your premier destination for top-tier entertainment and potential rewards.

The Digital Gaming Hall: A Modern Entertainment Hub

The Digital Gaming Hall hums with invisible energy, a nexus where pixels and passion collide. Once solitary, gaming now thrives here as a shared spectacle, with rows of focused competitors and theaters broadcasting epic esports finals to roaring crowds. This modern hub champions community connection, blending cutting-edge play with social spaces like VR arenas and developer meet-and-greets. It is a cathedral not of silence, but of coordinated keystrokes and collective gasps. More than just entertainment, it’s a cultural forge for digital storytelling, where every visitor becomes part of the unfolding narrative.

Exploring the Variety of Virtual Games

The Digital Gaming Hall hums with the quiet intensity of modern leisure, a sanctuary where glowing screens connect players to vast virtual worlds. Here, high-performance rigs and immersive consoles offer unparalleled gaming experiences, fostering communities that transcend physical space. This evolution of the arcade provides a premier destination for competitive esports, transforming spectators into part of the thrilling narrative unfolding on stage.

Q: Is it only for expert gamers?

A: Not at all. These hubs cater to all skill levels, from casual players enjoying social titles to seasoned pros training for tournaments.

Live Dealer Experiences: Bringing the Floor to You

The Digital Gaming Hall hums as a vibrant nexus for interactive entertainment, its virtual doors open to all. Here, epic narratives unfold not on pages, but in lush, living worlds where players become heroes. It’s a communal space for shared triumphs, where a speedrun draws collective breath and a hard-fought victory echoes across continents. This modern hub transforms solitary play into a connected, global spectacle.

From Slots to Tables: Understanding Game Categories

Stepping into The Digital Gaming Hall, the hum of excitement is immediate. This modern entertainment hub transcends solitary screens, fostering vibrant communities around shared digital adventures. From the glow of high-performance esports arenas to immersive VR landscapes, it curates cutting-edge interactive experiences. The venue masterfully blends competitive tournaments with casual social play, establishing itself as a premier destination for immersive entertainment. Here, pixels and passion collide, creating unforgettable nights where every player finds their thrill.

Navigating the Virtual Gaming Landscape Safely

Navigating the virtual gaming landscape safely requires proactive digital hygiene. Always use unique, complex passwords and enable two-factor authentication on gaming accounts to protect your personal data. Be cautious with voice chat and in-game messaging; never share private information with strangers. Regularly review privacy settings on consoles and platforms to control your visibility. Furthermore, purchase games and in-game currency only through official stores to avoid scams. Cultivating these habits ensures your online interactions remain secure and enjoyable, allowing you to focus on the immersive experience.

Identifying Trusted and Licensed Platforms

Venturing into the virtual gaming landscape requires both enthusiasm and caution. To protect your digital identity, always enable two-factor authentication and create strong, unique passwords for each platform. Be mindful of in-game communications, treating personal details as valuable loot you never drop.

Remember, a real friend will never ask for your password or account details, no matter the epic reward promised.

This mindful approach is key to practicing essential online gaming safety tips, ensuring your adventures remain thrilling and secure from any hidden threats.

Implementing Effective Personal Budget Controls

Navigating the virtual gaming landscape safely requires proactive digital citizenship. Protect your personal information by using strong, unique passwords and enabling two-factor authentication on every account. Be critical of in-game interactions, using mute and report functions for toxic behavior. **Secure online gaming practices** are essential, as is discussing digital boundaries with younger players to foster a positive experience where strategy and community thrive without compromise.

Recognizing Fair Play and RNG Certification

Navigating the virtual gaming landscape safely means protecting more than just your in-game character. Start by using strong, unique passwords and enabling two-factor authentication on every account to prevent unauthorized access. Be mindful of what personal information you share in chats or profiles, as oversharing can make you a target. Finally, take regular breaks to maintain a healthy balance between your digital adventures and real-world well-being. Prioritizing online gaming security ensures your fun remains uninterrupted and secure.

Maximizing Your Play with Bonuses and Promotions

To truly maximize your play, view bonuses and promotions as strategic tools, not just free gifts. Start by thoroughly reading the terms and conditions, focusing on wagering requirements and game contributions. This allows you to identify offers with genuine player value and high conversion potential. Align promotions with your preferred games; use free spins on new slots or leverage match deposits for extended table game sessions. A disciplined approach turns these incentives into a powerful bankroll extension, significantly boosting your entertainment and winning opportunities through smart bankroll management.

Decoding Welcome Offer Terms and Conditions

To truly maximize your play, strategically leveraging bonuses and promotions is essential. This approach significantly boosts your bankroll management, allowing for extended sessions and bolder strategic bets. Always read the terms, focusing on wagering requirements and game contributions, to convert offers into real withdrawable cash. This calculated use of promotional incentives transforms a standard gaming session into a more profitable and thrilling experience.

Strategies for Leveraging Free Spin Opportunities

Navigating the casino landscape is an art, and the savvy player knows that bonuses are their secret map. Treat each promotion not as free cash, but as a strategic tool to extend your session and explore new games with reduced risk. This careful approach to online casino bankroll management transforms a simple welcome offer into a prolonged adventure. By always reading the terms, you unlock the true potential of every deal, turning promotional fuel into genuine playtime and, with a bit of luck, real rewards.

The Role of Loyalty and VIP Reward Programs

Navigating the casino lobby can feel overwhelming, but the savvy player sees a landscape of opportunity. By strategically claiming welcome bonuses and diligently tracking weekly reload offers, you effectively extend your bankroll and increase your playtime. This practice of strategic bankroll management transforms promotions from mere perks into powerful tools. It’s the art of turning the house’s generosity into your extended adventure, where every free spin or matched deposit is a new chapter in your session.

Essential Financial Tools for Players

Every player, from the rookie to the veteran, needs a reliable financial toolkit to navigate the game of wealth. It begins with a disciplined budget, the fundamental playbook that tracks every income and expense. This is powered by a robust savings account, a defensive fortress for future goals, and grows through strategic investments—the offensive drive for long-term prosperity. Finally, a clear understanding of credit scores and debt management acts as the crucial rulebook, ensuring smart leverage and financial health for every quarter of the fiscal year.

Comparing Deposit and Withdrawal Method Speeds

Mastering the game requires the right **personal finance management strategies**. Players must leverage dynamic tools like budgeting apps to track cash flow, investment platforms for long-term growth, and automated savings mechanisms to build a safety net. A clear understanding of credit instruments and insurance products is equally critical https://boomerangbetca.com/ for protecting assets.

Consistent tracking of income and expenses is the non-negotiable foundation of financial stability.

By integrating these resources, individuals can strategically control their economic destiny and play to win.

Security Protocols for Financial Transactions

For any player looking to build lasting wealth, mastering a few essential financial tools is non-negotiable. A detailed budget is your playbook, tracking every dollar in and out. Automating savings and investments ensures you consistently pay your future self first, a cornerstone of **personal finance management**. Finally, a simple emergency fund acts as your financial safety net, protecting you from life's unexpected penalties without derailing your long-term goals.

Understanding Processing Times and Potential Fees

For players navigating the gaming economy, mastering a few essential financial tools is key to long-term success. A dedicated gaming budget is your first line of defense, helping you track spending on new releases and in-game purchases. Utilizing a digital expense tracker can turn sporadic spending into a smart financial strategy. Remember, the goal is to fund your passion without it undermining your financial health. This proactive approach is fundamental for effective **bankroll management**, ensuring you always play within your means.

The Pivotal Role of Mobile Gaming

Mobile gaming has fundamentally transformed the global entertainment landscape, becoming a primary gateway to interactive media for billions. Its accessibility, driven by ubiquitous smartphones, has democratized gaming, reaching demographics previously untapped by traditional consoles. This massive, engaged audience has made the platform a major economic force, driving innovative monetization models like free-to-play. Beyond entertainment, mobile games serve as potent tools for education and social connection, fostering communities and even facilitating informal learning. The sector's influence on design trends, marketing strategies, and technology adoption continues to shape the entire digital industry.

Dedicated Apps Versus Mobile-Optimized Browsers

The **pivotal role of mobile gaming** extends far beyond entertainment, fundamentally reshaping digital interaction and culture. Its primary advantage is unprecedented accessibility, placing powerful, engaging experiences directly into billions of pockets worldwide. This democratization of play has created a dominant **mobile gaming market**, driving innovation in short-form content, social connectivity, and even novel learning tools. The platform's influence is undeniable, making it the central arena for the future of interactive media and community engagement.

Features of a High-Quality Gaming App

The ubiquitous nature of smartphones has cemented mobile gaming's pivotal role as the primary gateway to interactive entertainment globally. Its accessibility drives unprecedented user acquisition and engagement, creating a dominant force in the digital marketplace. For developers, mastering mobile-first game design is no longer optional but essential for capturing this vast, on-the-go audience and achieving sustainable growth in a saturated app ecosystem.

Gaming on the Go: Connectivity and Performance

Mobile gaming has fundamentally transformed the digital entertainment landscape, becoming a primary gateway to interactive media for billions globally. Its accessibility drives unprecedented engagement, allowing for casual gaming experiences during brief moments of downtime. This constant connectivity fosters vibrant online communities and has established smartphones as a dominant platform for both indie developers and major studios, shaping modern play patterns and social interaction.

Prioritizing Responsible Play and Player Wellbeing

Prioritizing responsible play and player wellbeing is foundational to a sustainable and ethical gaming ecosystem. This commitment extends beyond basic compliance, requiring proactive measures like customizable spending limits, clear time management tools, and accessible resources for support. Integrating these player protection features directly into the user experience demonstrates a duty of care. Ultimately, fostering a balanced environment where responsible gaming is encouraged protects both the individual's welfare and the long-term health of the community and the industry itself.

Setting Personal Limits and Recognizing Boundaries

Prioritizing responsible play and player wellbeing is a cornerstone of sustainable gaming. This expert approach involves implementing clear tools like deposit limits, time reminders, and self-exclusion options directly within the platform. It also means providing easy access to support resources and promoting a balanced lifestyle. Promoting safe gambling practices protects both the individual and the integrity of the ecosystem, fostering a healthier community and ensuring long-term engagement. Ultimately, safeguarding player welfare is both an ethical imperative and a critical business practice.

Utilizing Self-Exclusion and Cooling-Off Tools

Prioritizing responsible play and player wellbeing is the cornerstone of a sustainable and ethical gaming ecosystem. This commitment extends beyond fun, integrating robust tools like deposit limits, reality checks, and self-exclusion options directly into the user experience. By fostering a culture of mindful engagement, the industry protects individuals while building lasting trust. This proactive approach to player protection standards ensures entertainment remains a positive force, safeguarding both community health and the integrity of the platform itself.

**Q: What are common responsible gaming tools?**

**A:** Key features include customizable deposit limits, session time reminders, temporary time-outs, and permanent self-exclusion options.

Accessing Support Resources for Healthy Habits

Prioritizing responsible play and player wellbeing is a fundamental ethical commitment for modern gaming platforms. This involves implementing clear tools like deposit limits, time reminders, and self-exclusion options to empower user control. Proactive measures also include providing direct access to support resources for those needing assistance. Promoting healthy gaming habits protects individuals and fosters a more sustainable and positive community for all participants, ensuring entertainment remains balanced and safe.

Experience the Thrill: Grab Your 200 Free Chips at Limitless Casino Canada!

Are you ready to dive into the electrifying world of online gaming? Look no further than Limitless Casino, where gaming knows no bounds and the excitement never ends! With an unbeatable promotion that offers 200 free chips with no deposit required, players in Canada are in for a spectacular ride. This article will explore everything you need to know about Limitless Casino, the fantastic offers available, and how to maximize your gaming experience!

Table of Contents

- What is Limitless Casino?

- Why Choose Limitless Casino?

- The 200 Free Chip Promotion

- Popular Games at Limitless Casino

- How to Get Started

- FAQs

What is Limitless Casino?

Limitless Casino is an innovative online gaming platform that caters primarily to Canadian players seeking a thrilling gaming experience. With a diverse range of games, state-of-the-art technology, and a user-friendly interface, Limitless Casino has quickly become a favorite among both seasoned gamers and newcomers alike.

Why Choose Limitless Casino?

- Diverse Game Selection: From classic table games to the latest video slots, Limitless Casino boasts an array of gaming choices that suit every taste.

- Exclusive Promotions: Besides the 200 free chips with no deposit, regular promotions and bonuses keep players engaged and rewarded.

- Safe and Secure: Your safety is paramount. Limitless Casino employs advanced encryption technology to protect your personal and financial information.

- Responsive Customer Support: Help is always available through live chat, email, or phone, ensuring your gaming experience is seamless.

The 200 Free Chip Promotion

The headline feature that puts the Limitless Casino on the map is the fantastic 200 free chip no deposit offer. Here's how it works:

- The offer is available for new players who create an account.

- No deposit is required, meaning you can start playing immediately without any financial commitment.

- The chips can be used on various games, allowing players to explore the casino without risking their own money.

How to Claim Your 200 Free Chips

- Visit the Limitless Casino website.

- Create your player account by following the sign-up prompts.

- Verify your email to ensure your account is active.

- Receive your 200 free chips automatically credited to your account.

- Start playing your favorite games!

Popular Games at Limitless Casino

Limitless Casino offers a vast selection of games designed to entertain and challenge players of all skill levels. Here are some of the most popular categories:

Slots

- Progressive Jackpots: Exciting games like Mega Moolah can change your life with massive payouts.

- Classic Slots: Enjoy the simplicity of traditional three-reel games.

- Video Slots: Immerse yourself in beautifully designed slots with captivating storylines.

Table Games

- Blackjack: Test your strategy against the dealer in one of the most popular card games of all time.

- Roulette: Place your bets and watch the wheel spin in this classic game of chance.

- Poker: Challenge your friends or play against other skilled players in thrilling poker tournaments.

Live Dealer Games

For a more immersive experience, try the live dealer games that bring the thrill of a physical casino to your screen. Watch and interact with real dealers as you play your favorite table games.

How to Get Started

Getting started at Limitless Casino is a breeze! Follow these simple steps to limitless-casino.us begin your gambling journey:

- Create an Account: Go to the Limitless Casino website and sign up by entering the required information.

- Claim Your Offer: Automatically receive your 200 free chips upon registration.

- Make Your First Deposit (Optional): If you choose to continue playing after your chips, consider making a deposit to unlock even more benefits.

- Choose Your Favorite Games: Explore the extensive library and find games that excite you.

- Play Responsibly: Remember to set limits and enjoy your gaming experience!

FAQs

1. Is Limitless Casino safe for players in Canada?

Absolutely! Limitless Casino takes player security seriously, employing advanced encryption systems to ensure both data and financial transactions are protected.

2. Can I truly claim 200 free chips with no deposit?

Yes! Limitless Casino offers this promotion to new players, allowing you to start gaming without any financial commitment.

3. What games can I play with my free chips?

Your 200 free chips can be used on a wide range of games, including slots, table games, and live dealer offerings.

4. What if I have issues or questions while playing?

The customer support team at Limitless Casino is available 24/7 to assist you with any inquiries or concerns, ensuring a seamless gaming experience.

5. Can I win real money with my free chips?

Yes! You can win real cash while using your 200 free chips, which adds an exciting layer to your gaming experience.

Limitless Casino beckons you to join its thrilling gaming landscape. With an enticing offer of 200 free chips with no deposit required, there's never been a better time to experience the excitement. Don't miss out—sign up today and let the games begin!

The Unfolding Drama of Casino Action: From the Spin to the Win

In the vibrant universe of gaming, casino action captures the imaginations of thrill-seekers everywhere. This article dives into the exhilarating dynamics of casino environments, exploring not only the games themselves but also strategies, psychology, and the intricate thrill that comes with every wager. Below is a comprehensive guide to navigating the captivating world of casino action.

Table of Contents

- Understanding Casino Action

- Types of Games

- Strategies for Success

- The Role of Psychology

- Responsible Gaming

- FAQs

Understanding Casino Action

The term casino action encompasses the various activities that unfold in a gaming establishment. It represents every spin of the slot machine, every card dealt, and every roulette wheel spin with high stakes on the line. The atmosphere is often charged with excitement, fueled by the anticipation of big wins and the risk of losses. Here are some key components that shape this action-packed environment:

- Game Variety: From poker to slots, there is something for everyone.

- High Energy: The noise of cheers, laughter, and clinking coins heightens the gaming experience.

- Player Interactions: Engaging with fellow players adds a communal aspect to gaming.

Types of Games

Casino action includes a multitude of games, each with its unique rules and appeal. Here’s a closer look at some of the most popular games:

| Game Type | Description | Skill Level |

|---|---|---|

| Slots | Spin the reels and match symbols to win. | No skill required |

| Blackjack | A card game where the goal is to reach 21 without busting. | Moderate; strategy involved |

| Roulette | Predict which number or color the ball will land on. | No skill required; luck-based |

| Poker | A strategic card game played against other players. | High; requires skill and strategy |

Strategies for Success

Regardless of the game, having a strategy can significantly enhance your casino action experience. Here are some effective techniques to keep in mind:

1. Know the Rules

Before playing any game, familiarize yourself with its rules and betting limits. Understanding the game mechanics can influence your decisions during play.

2. Bankroll Management

Set a budget for your gaming session and stick to it. This helps in maintaining control over your spending and prolongs the enjoyment of your experience.

3. Play Games with a Low House Edge

Consider games that offer better odds to players, such as blackjack or poker. The lower the house edge, the better your chances of winning.

4. Take Advantage of Bonuses

Many casinos offer bonuses and promotions. Utilize these to maximize your gaming budget. However, always read the fine print related to wagering requirements.

5. Practice

If you're new to a game, playing for free online can help you build confidence and develop your strategy without risking money.

The Role of Psychology

The psychological aspects of casino action can significantly impact player behavior. Here are some psychological principles at play:

- Loss Aversion: Players often continue to gamble in an attempt to recover losses, which can lead to poor decision-making.

- The Gambler's Fallacy: The belief that past events can influence future odds can lead to dangerous gambling behaviors.

- Reward Systems: The brain releases dopamine when players win, reinforcing the behavior and often leading to increased risk-taking.

Responsible Gaming

Engaging in casino action should always be a fun and enjoyable experience. Here are some tips for responsible gaming:

- Set Limits: Determine time and money limits before you start playing.

- Self-Awareness: Be conscious of your emotions and how they influence your gaming behavior.

- Take Breaks: Step away from the game to clear your mind and reassess your strategy.

- Seek Help: If gaming becomes a compulsive behavior, consider seeking professional guidance.

FAQs

Here are some frequently asked questions about casino action:

What is casino action?

Casino action refers to the various activities that occur in a casino setting, including gaming, betting, and social interactions.

What games are the best for beginners?

Beginner-friendly games include slots and roulette, as these require minimal strategy and are based largely on luck.

How can I avoid gambling addiction?

Set limits on your time and money spent playing, and be aware of your emotional state while gambling. Don’t hesitate to seek help if needed.

What is the house edge?

The house edge is the mathematical advantage that the casino has over players in any given game.

In conclusion, the world of casino action is a thrilling confluence of chance, strategy, and psychology. casino action By understanding the games, expertly navigating the excitement, and practicing responsible gaming, players can create an enjoyable and rewarding experience while indulging in the excitement of chance. As you roll the dice or spin the reels, remember that it’s all about having fun while embracing the unpredictable journey that each game offers.

The Enchantment of Royal Vegas Casino: A Gateway to Thrilling Entertainment

Table of Contents

- Introduction

- What is Royal Vegas Casino?

- Diverse Game Selection

- Promotions and Bonuses

- User Experience and Interface

- Customer Support

- Conclusion

Introduction

Welcome to the captivating realm of Royal Vegas Casino, where the thrill of gaming meets the elegance of a royal experience. This online casino offers an extensive selection of games, rewarding bonuses, and an immersive user interface, making it a popular choice for gaming aficionados worldwide. Whether you're a novice seeking entertainment or a seasoned player on the hunt for your next big win, Royal Vegas Casino has something for everyone.

What is Royal Vegas Casino?

Royal Vegas Casino is a premier online gambling platform that provides players with access to a multitude of games ranging from classic slots to sophisticated table games. Established in 2000, this online casino has built a reputation for offering a safe and secure environment, stunning graphics, and innovative gameplay. Powered by Microgaming, one of the leaders in online gaming software, Royal Vegas ensures a high-quality gaming experience.

Key Features of Royal Vegas Casino

- Licensed and regulated by acknowledged authorities.

- Compatible with various devices including desktops, tablets, and mobile phones.

- Offers a plethora of payment options for deposits and withdrawals.

- Regularly audited for fair play and transparency.

Diverse Game Selection

The heart of any casino lies in its game offerings, and Royal Vegas Casino certainly does not disappoint. With hundreds of games at your fingertips, players can indulge in a variety of royalvegasnz.com gaming styles.

Slots

Slots are a major attraction, featuring themes that cater to different tastes. Some popular slot games include:

- Book of Oz

- Aloha: Cluster Pays

- Immortal Romance

- Thunderstruck II

- Hitman

Table Games

For those who prefer the strategic elements of gaming, Royal Vegas offers a range of classic table games:

- Blackjack

- Roulette

- Baccarat

- Craps

- Casino Hold'em

Live Dealer Games

Experience the thrill of a real casino with live dealer games where players can interact with real dealers in real-time. Some available games include:

- Live Blackjack

- Live Roulette

- Live Baccarat

Promotions and Bonuses

Royal Vegas Casino excels in providing rewarding promotions designed to enhance the gaming experience. New players are often greeted with a generous welcome bonus, while regular players can benefit from ongoing promotions and loyalty programs.

Welcome Bonus

New players can expect an enticing welcome package that might include:

- 100% match bonus on the first deposit.

- Additional bonuses on second and third deposits.

Loyalty Program

Loyal players are rewarded through the Royal Vegas loyalty program where they can earn points for every wager made:

- Redeem points for real cash.

- Access exclusive bonuses and promotions.

User Experience and Interface

The user experience at Royal Vegas Casino is designed with simplicity and enjoyment in mind. The website features:

- A clean and intuitive layout for easy navigation.

- Responsive design for compatibility with mobile devices.

- Fast loading times, ensuring seamless gaming.

Customer Support

The team at Royal Vegas Casino is dedicated to providing top-notch customer support. Players can reach out for assistance through:

- 24/7 Live chat for instant help.

- Email support for detailed inquiries.

- Extensive FAQ section addressing common issues.

Conclusion

In summary, Royal Vegas Casino presents a mesmerizing gaming experience with its extensive game selection, generous bonuses, and user-friendly interface. Whether you’re there to chase the next big jackpot or simply seeking some fun, Royal Vegas delivers an experience fit for royalty. Dive into the enchanting world of online gaming and discover what makes Royal Vegas Casino a favorite among players globally!

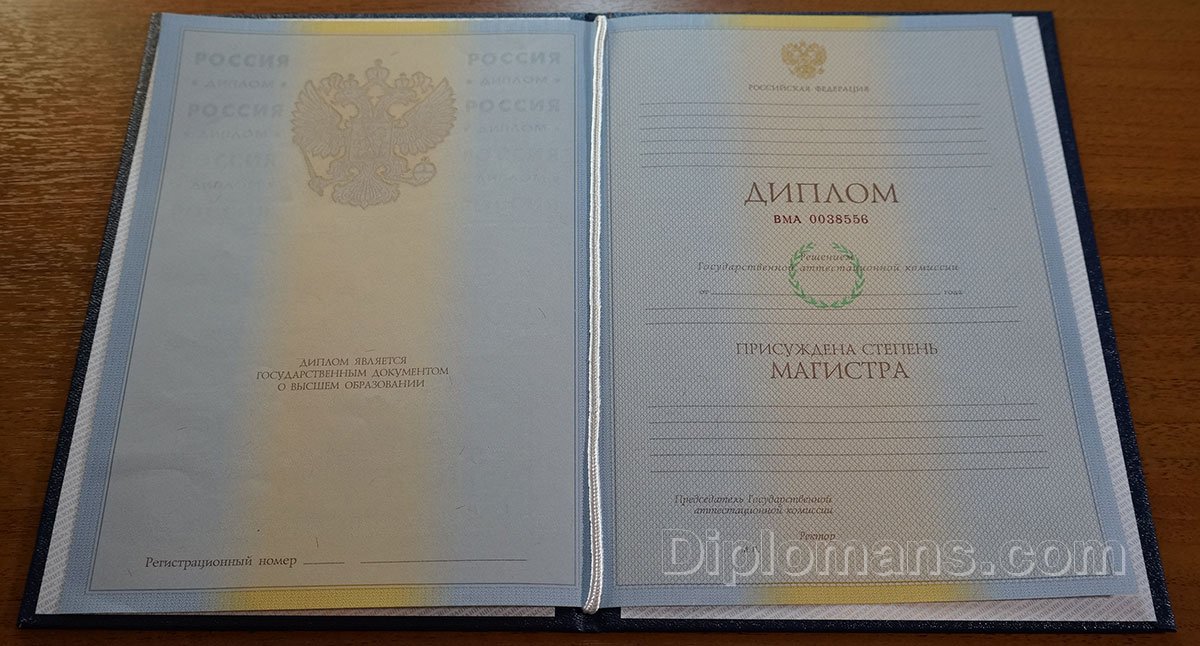

В современном мире диплом стал важным документом для достижения карьерных высот и получения престижной работы. В связи с этим многие люди задумываются о том, как быстро получить диплом, не проходя все этапы обучения. Поэтому Купить диплом университета стало популярной темой. В этой статье мы рассмотрим преимущества и риски этого решения, а также поделимся советами по выбору надежного поставщика дипломов.

Почему люди покупают дипломы?

Покупка диплома может быть обусловлена множеством факторов. Во-первых, многие люди хотят сэкономить время, которое требуется на обучение. Образовательный процесс включает в себя не только занятия, но и выполнение различных заданий, курсовых работ и экзаменов, что может занять много времени.

Во-вторых, в условиях жесткой конкуренции на рынке труда диплом определенного вуза может стать ключевым фактором при найме на работу. Многие работодатели предпочитают соискателей с дипломами известных учебных заведений, что может подталкивать людей на поиск быстрых способов получения такого документа.

В-третьих, некоторые категории граждан, такие как военнослужащие или работники, занятые в бизнесе, могут не иметь возможности или желания тратить несколько лет на обучение. На фоне дефицита времени, фальшивый диплом может кажется им более разумным решением.

Преимущества покупки диплома

Несмотря на риски, связанные с подделкой диплома, необходимо отметить несколько потенциальных преимуществ такого решения:

- Экономия времени: желание получить диплом без курса обучения позволяет в кратчайшие сроки устроиться на желаемую работу.

- Доступ к большему количеству вакансий: многие работодатели требуют наличие диплома, и наличие этого документа может открыть двери к новым возможностям.

- Потенциальное увеличение дохода: диплом может помочь в получении более высокой зарплаты на начальном этапе карьеры.

Риски и недостатки

Тем не менее, важно понимать и осознавать риски, связанные с покупкой диплома. Вот некоторые из них:

- Юридические последствия: подделка диплома является уголовно наказуемым деянием в большинстве стран, что может привести к серьёзным проблемам с законом.

- Репутационные риски: если работодатель обнаружит подделку, это может привести к потере работы и негативно сказаться на вашей карьере.

- Неэффективность: Диплом, полученный без получения знаний и навыков, может оказаться бесполезным, если вас попросят продемонстрировать свои умения.

Как выбрать надежного поставщика дипломов?

Если вы все же решили купить диплом, важно подобрать надежного и проверенного продавца. Вот основные советы:

- Изучите отзывы: ищите отзывы других клиентов, чтобы понять, насколько надежен сервис.

- Проверяйте легальность: убедитесь, что компания действует в рамках закона и предлагает лицензированные дипломы.

- Обращайте внимание на качество: диплом должен быть выполнен на высоком уровне, включая водяные знаки и другие защитные элементы.

- Запрашивайте образцы: попросите образцы дипломов, чтобы оценить качество и оформление.

Заключение

Покупка диплома университета может показаться быстрое и удобное решение, но важно взвесить все «за» и «против». Прежде чем принимать такое решение, тщательно обдумайте возможные риски и последствия. Лучше всего уделить время на получение образования, поскольку оно может предоставить вам необходимые знания и навыки, которые пригодятся в профессиональной жизни. Если же вы все равно решили купить диплом, подходите к этому вопросу с умом: выбирайте надежных поставщиков и будьте готовы к возможным последствиям.

I Segreti Nascosti di Jackpot City: Un Viaggio nel Cuore del Gioco Online

Benvenuti in questo affascinante viaggio nel mondo di Jackpot City, un emozionante casinò online dove la fortuna incontra il divertimento. Scopriremo insieme tutto ciò che rende questa piattaforma così unica, da giochi da tavolo a slot machine, fino alle strategie per vincere. Siete pronti a scoprire i segreti del successo? Iniziamo!

Indice dei Contenuti

- 1. Introduzione a Jackpot City

- 2. I Giochi Disponibili

- 3. I Bonus e le Promozioni

- 4. Strategie per Vincere

- 5. Domande Frequenti

- 6. Conclusione

1. Introduzione a Jackpot City

Jackpot City è una delle destinazioni più rinomate nel panorama dei casinò online. Fondata nel 1998, offre un'esperienza di gioco emozionante e sicura, con un'interfaccia user-friendly e una vasta gamma di opzioni di gioco. La piattaforma è regolamentata e dispone di licenze adeguate, garantendo un ambiente di gioco equo e responsabile.

2. I Giochi Disponibili

Uno dei punti di forza di Jackpot City è la sua impressionante selezione di giochi, che soddisfa i gusti di tutti i tipi di giocatori. Ecco un elenco dei principali giochi disponibili:

- Slot Machine: Da classiche a video slot con grafica avanzata.

- Giochi da Tavolo: Blackjack, Roulette e Poker, con varianti diverse.

- Giochi di Carte: Baccarat e molte altre emozionanti opzioni.

- Casinò Live: Gioca contro croupier dal vivo per un'esperienza autentica.

Slot Machine in Evidenza

Le slot machine sono senza dubbio l'attrazione principale di Jackpot City. Ecco alcune delle più popolari:

| Nome del Gioco | Caratteristiche | RTP (Return to Player) |

|---|---|---|

| Thunderstruck II | Grafica epica, Wilds e Free Spins | 96.65% |

| Immortal Romance | Storia avvincente, bonus e jolly multipli | 96.86% |

| Mega Moolah | Jackpot progressivo e divertimento garantito | 88.12% |

3. I Bonus e le Promozioni

Jackpot City non è solo un luogo dove giocare, ma anche dove ottenere vantaggi incredibili. La piattaforma offre una serie di bonus e promozioni per attrarre nuovi giocatori, inclusi:

- Bonus di Benvenuto: Fino a €1600 suddivisi sui primi quattro depositi.

- Promozioni Settimanali: Offerte jackpotcitycasinoitalia.com aggiornate ogni settimana per mantenere alta l'attenzione.

- Programma Fedeltà: Accumula punti per ogni scommessa e guadagna premi esclusivi.

4. Strategie per Vincere

Giocare a Jackpot City può sembrare semplice, ma esistono strategie che possono aumentare le vostre possibilità di vincita:

- Conoscere i Giochi: Imparare le regole e le strategie specifiche di ogni gioco.

- Gestione del Budget: Stabilire limiti di spesa e rispettarli è fondamentale per un gioco responsabile.

- Sfruttare i Bonus: Usare i bonus e le promozioni per massimizzare il proprio capitale di gioco.

- Praticare con i Giochi Gratis: Molti giochi offrono modalità demo per esercitarsi senza rischi.

5. Domande Frequenti

Come posso iscrivermi a Jackpot City?

Visita il sito ufficiale di Jackpot City e clicca su "Registrati". Compila il modulo con i tuoi dati e conferma la tua iscrizione.

È sicuro giocare su Jackpot City?

Sì, Jackpot City utilizza crittografia avanzata per proteggere le informazioni dei giocatori e offre una licenza di gioco valida.

Quali metodi di pagamento sono disponibili?

Il casinò accetta diversi metodi di pagamento, tra cui carte di credito, portafogli elettronici e bonifici bancari.

Posso giocare da mobile?

Assolutamente! Jackpot City è compatibile con dispositivi mobili, permettendoti di giocare ovunque e in qualsiasi momento.

6. Conclusione

Jackpot City rappresenta una delle esperienze di gioco online più emozionanti e intriganti disponibili oggi. Con una gamma vasta di giochi, vantaggi allettanti e un ambiente sicuro, è la scelta ideale per chi cerca avventure e vincite. Non aspettare oltre, unisciti a noi nel mondo scintillante di Jackpot City e scopri come i tuoi sogni possono trasformarsi in realtà!